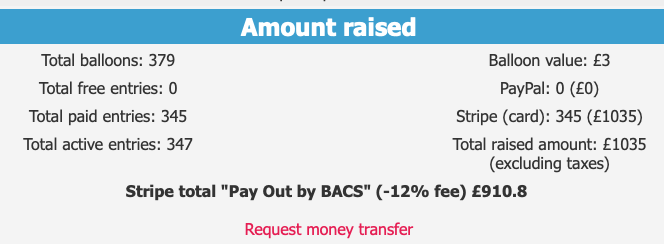

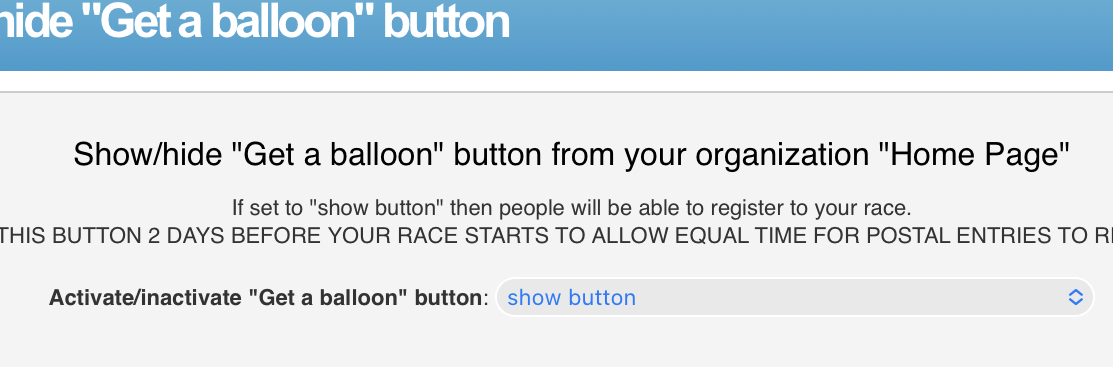

You can now accept card payments by simply selecting “show” for the buy button. On a test sample of 100 races we sent an average BACS payment of £272.40 per race after the 12% fee had been deducted (this is an average of 108 balloons per race sold @ £3 each).

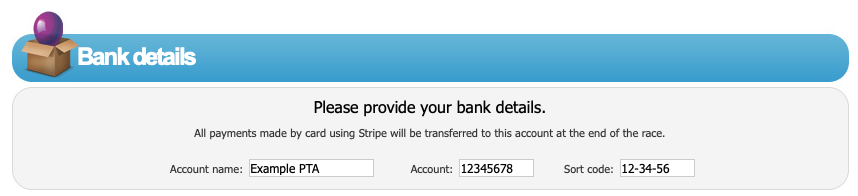

We collect the card payments (by Stripe) and pay out by bacs as your race starts. The admin area calculates your bacs payout less a 12% fee. Click “Request Money Transfer” to receive your bacs payment. Example automated email.

The advantage of card payments is everything is automated. There’s no CSV upload or chasing people for payments. At the point the balloon is created and paid it’s added to your race.

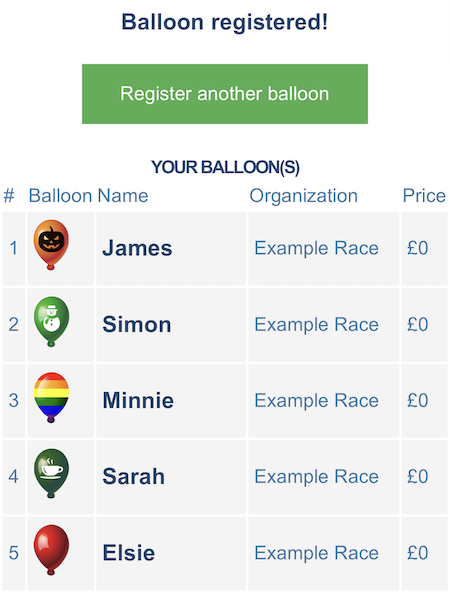

We have a visual shopping cart when buying multiple balloons and a confirmation email. The shopping cart is created without the need for logging in (no password required).

The minimum order transaction is £3 (minimum cost per balloon or duck).

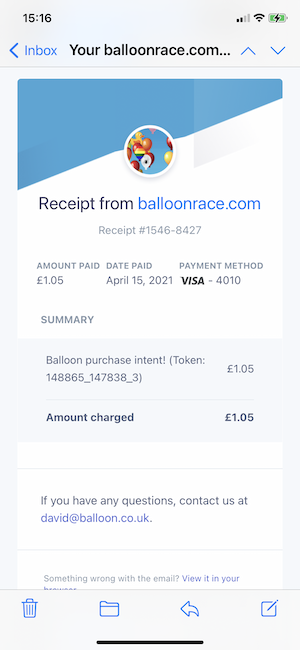

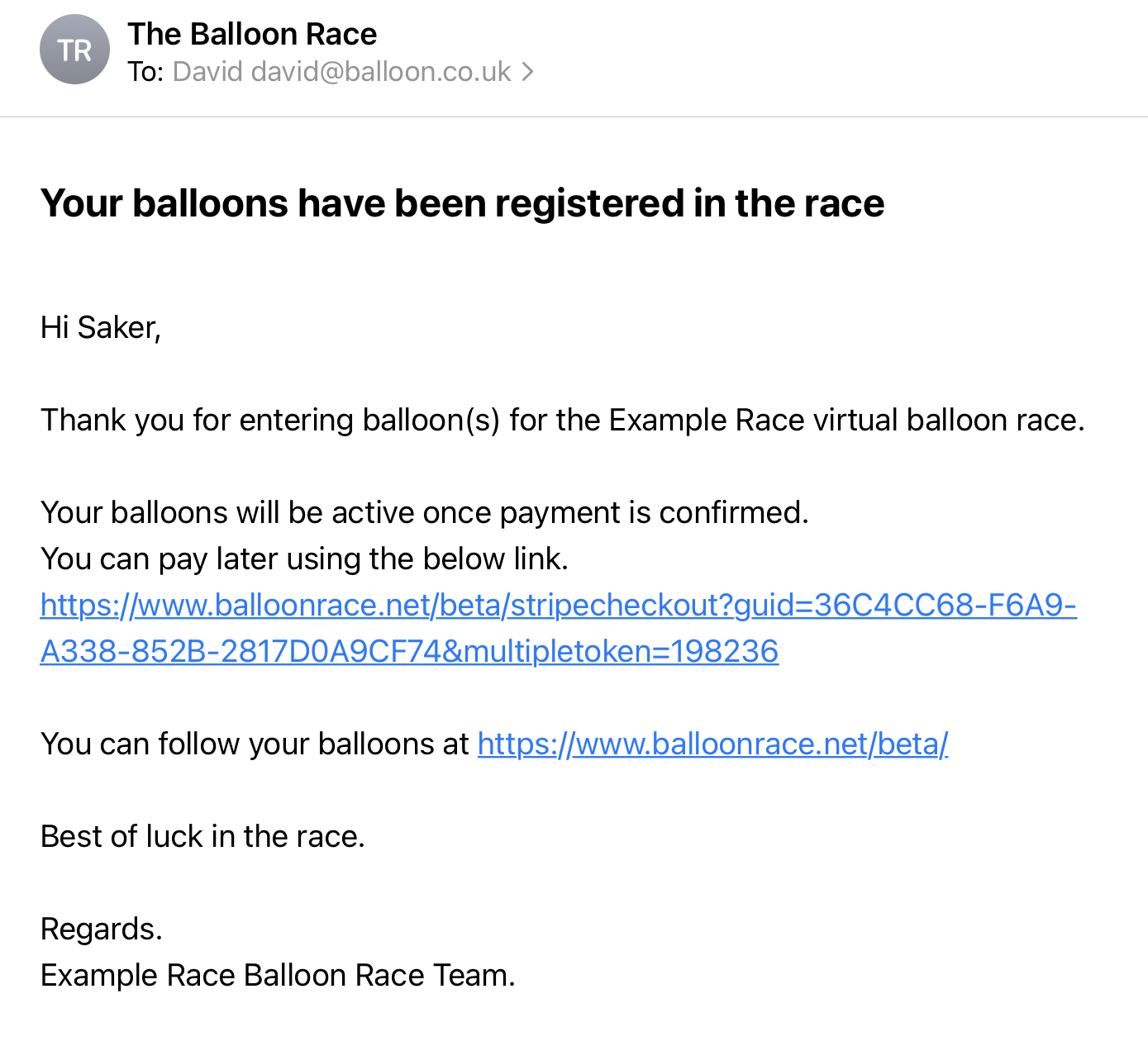

Your customers receive 2 emails receipt:

Our Charges

The 12% charge covers our fee, stripe, BACS & VAT. Read more about why we charge 12% + legal details below as to why we have to charge VAT.

The VAT analysis of the Balloon Company’s charges is the VAT is due on the full 36p retained by the balloon company. The service being provided by the balloon company is a form of financial service but this service is excluded from the VAT exemption that applies to many financial services. For VAT purposes the service being offered by the balloon company would be categorised under the heading of debt collection services. Following the European Court of Justice decision in the HMRC v Axa UK plc case HMRC stated in their Brief 54/10 that debt collection services does not apply solely to the service of chasing and recovering overdue payments on behalf of the creditor. All services principally concerned with collecting payments from the person owing them for the benefit of the entity to which those payments are owed (regardless of whether those payments are received before, on or after their due date) fall within the exclusion to the exemption. See also paragraphs 1.6 and 5.10 of HMRC Public Notice 701/49 on Finance.

The consideration that the balloon company receives for its service is the full 36p and not the 12p (36p less Stripe banking charges). The transaction charge levied by the balloon company’s card provider is a cost component of the balloon company’s service and cannot be ignored for the purposes of establishing the VAT liability of the company’s service.